Talking Points:

- False breakouts can lead to ugly situations.

- We can avoid many false breakouts by waiting for the candle to close.

- To save time we can use price alerts based on candles’ closing prices.

Breakout trading can be a rewarding strategy in volatile markets, but is often plagued with fake signals and false breakouts that can discourage even the best traders. Today, we will cover what a fake breakout is and how to avoid them in our trading.

What is a False Breakout?

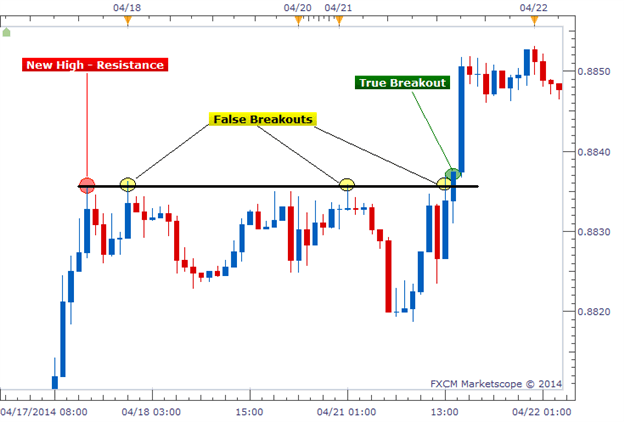

A false breakout is when price temporarily moves above or below a key support or resistance level, but then later retreats back to the same side as it started. This is the worst case scenario for a breakout trader that enters in a trade as soon as price breaks. We are immediately faced with a red arrow on our chart and the breakout we traded is looking less and less real.

Being forced to watch as breakout trades disintegrate in front of us is tough to swallow, and we are left deciding whether we should stay in and “ride it out” or close the trades for a quick loss. Neither of those options sound very appealing. So to avoid this in the future, we need to add a new rule to our existing breakout trading strategy.

Learn Forex: Avoiding False Breakouts

How to Avoid a False Breakout

The solution to this problem is actually pretty simple (as depicted above). Rather than act on a trade in real time as soon as price breaks a key level, we should wait until the candle closes to confirm the breakout’s strength. So the idea of setting entry orders above or below a support or resistance levels to automatically get us into a breakout trade is not a very good one. Entry orders allow us to get “wicked” into breakout trades that never actually materialize.

On the surface, this would lead us to believe that the only way to effectively trade breakouts, is to be at our trading terminals ready to act as soon as the candle closes in breakout territory. Once the candle closes, we can then open our position that hopefully has a higher chance of success. But what if we don’t have all day to sit around and wait for breakouts?

Setting Alerts Based on the Candles’ Close Prices

So, if physically waiting at your computer for a breakout is not an option, I recommend using a price alert that uses each candle’s closing price as its trigger. In other words, you will only receive an alert if support or resistance is broken and remains broken through the close of that specific candle. That way you can receive your alert, log in on your computer or mobile application and place the trade.

Once selected, we will only be alerted if a candle closes beyond the price level we selected rather than alerted as soon as the price is broken in real time. For an hourly chart, that mean we could only be alerted at the top of the hour, after each bar closes. This is exactly what we were looking for.

Avoiding False Breakouts

This tiny tweak can make a big impact on your breakout trading. But like always, I recommend making these changes to your strategy in a demo environment before testing them with real money.

Good trading!

---Written by Rob Pasche

Interested In Our Analyst's Best Views On Major Markets? Check Out Our Free Trading Guides Here