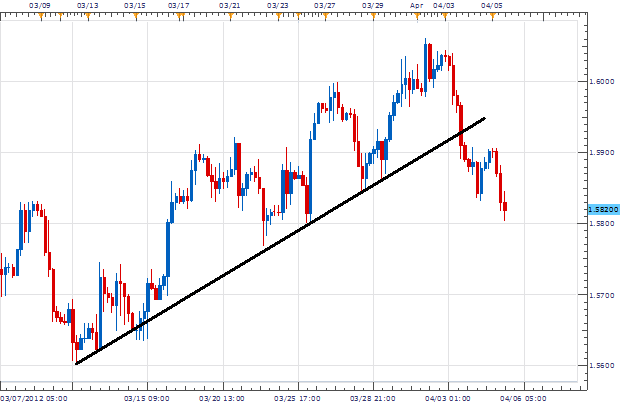

Tomorrow again brings about the potential market moving news event, Non-Farm Payrolls. As the market braces for an expected value of 205k, traders are beginning to look for momentum prior to the event. Below we have a GBPUSD 4hr chart depicting a breakout of previous support levels. Support was seen rising from the March 12th low at 1.5601 up to the April second high at 1.6062. Price has since broke lower this week shifting our market bias downwards. If price continues to break new lows, traders will turn to current support levels to extract points of entry into the market.

Another way of extrapolating support on the GBPUSD is by matching up the wicks near the 1.5800 price figure. This price has been tested seven times on our graph, starting on March 22nd when price reached a low of 1.5769. Today’s low currently stands near support at 1.5804. As tomorrow’s news looms, breakout traders can prepare by setting entries to sell the market under the previous low.

In the event that price surges higher against our expectations, the same strategy can be used for entries above resistance by connecting the current highs from April 3rd and 5th. A break above this point on the graph would change our bias back to the upside looking for the creation of higher highs.

My preference is to sell the GBPUSD on a break of support under 1.5769. Stops should be placed over resistance at 1.5869. Limits should look for pricing targeting 200 pips at 1.5569 for a clear 1:2 Risk/Reward profile.

Alternative scenarios include price breaking upward out of our 4HR triangle, triggering fresh buy orders.

---Written by Walker England, Trading Instructor

To contact Walker, email WEngland@FXCM.com . Follow me on Twitter at @WEnglandFX.

To be added to Walker’s e-mail distribution list, send an email with the subject line “Distribution List” to WEngland@FXCM.com .

DailyFX provides forex news on the economic reports and political events that influence the currency market. Learn currency trading with a free practice account and charts from FXCM.