Bias: Bullish EURUSD Toward Weekly S2

Point to Establish Long Exposure: Close Above 1.1306

Target 1: 115.50 weekly S1 Pivot

Target 2: 118.20 61.8% Toward Double Bottom Target

Invalidation Level: 1.1130 Internal Level (Elliott Wave Based)

Last Week’s Price Action Recap:

Does your neck hurt? If so, it may be whiplash from watching EURUSD last week. DailyFx on Demand provides audible access to bank insurance and even Top-Tier institutions were awe-struck by the move. Many in DailyFX, including yours truly, were looking to 1.1430/60 as firm resistance. On Last week’s amazing volatility, where EURUSD posted its highest volume day of 2015, rsistance was cut like a hot knife through butter as confusion and price discovery were widespread.

Technical Focus:

The channel of Andrew’s Pitchfork may help to provide a bit of a roadmap to the twists and turns. Internal pivots (black trendlines within the pitchfork) have shown to support and resist price action. We’re sitting on an internal level of support now and if that doesn’t hold, we could see a test of the lower bound structural support at 1.1017/21 and the Weekly S1 Pivot at 1.0985. The confusion is similar to USDJPY when it becomes trapped in sideways price action like we’ve seen many times over the past 3 years. However, a study of correlations show that EURUSD & USDJPY show the tightest correlation in 8 years, which could mean that they’re starting to mirror each other in behavior. If that’s the case, we could be seeing a sideways move that would favor playing the range and staying away from breakouts that can act as price traps.

2nd resistance: 1.1485 233-DMA

1st resistance: 1.1364 Aug. 27 high

Spot: 1.1206

1st support: 1.1147 21-DMA

2nd support: 1.1106 55-DMA

Sentiment:

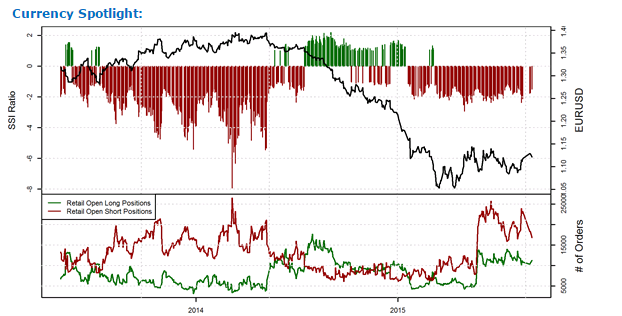

EURUSD - The ratio of long to short positions in the EURUSD stands at -1.50 as 40% of traders are long. We use our SSI as a contrarian indicator to price action, and the fact that the majority of traders are short gives signal that the EURUSD may continue higher.